The DVLA has made an important rule change concerning the entitlement to free road tax. Here’s what you need to know…

Don’t worry, they’re not getting rid of the rolling entitlement afforded to vehicles once they reach their 40th birthday. However, the DVLA has tightened up on the rules which previously allowed owners of vehicles made in the latter part of the previous year but not registered until after 31 December to duck out of having to pay an annual Vehicle Excise Duty (VED).

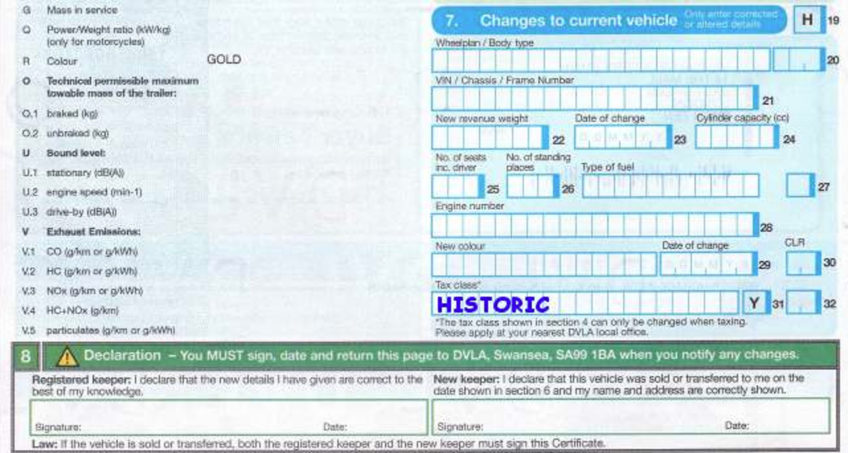

When the historic vehicle exemption was first introduced, the DVLA intended to grant free road tax to vehicles based on when they were first registered, 31 December being the annual cut-off date in order to qualify. However, mindful of the fact that vehicles made in the latter part of the previous year may have sat around, unregistered, until well into the new year – especially if they were made abroad – the Federation of British Historic Vehicle Clubs (FBHC) managed to negotiate a compromise. Specifically, if an owner could provide proof of build date via a ‘VW birth certificate’, for example, then a note would be made on the V5C and they could qualify for free VED. No doubt several Mk1 Golf owners benefitted from the creation of this totally legal loophole.

The new rules mean this will no longer be the case, and for 1976-on vehicles, Historic Vehicle road tax will be determined only by the date of registration. This is despite the simple fact that it is virtually impossible to make a car and register it on the same day. In short, what it means is that lots of car owners that would previously have been let off paying road tax because their vehicle reached 40 years old will now have to wait another year.

The DVLA blames a new system of registration from 1976/7 on the rule changes, whereby a vehicle was declared as ‘new and unused’ when first registered. As we understand it, vehicles that already qualify for free road tax won’t be affected.

Needless to say, the FBHC are arguing their case – stating that DVLA’s interpretation cannot be correct and that people are being required to pay VED when they should be exempt. To that end the FBHC urges anyone who’s had their application to have their V5C amended to show their car was manufactured in 1976 (but registered in 1977) rejected to get in touch via their website here.

Ian

The opinions expressed here are the personal opinions of the author and do not necessarily represent the views and opinions of VW Heritage

My VW bay is 1-1-1978. Can i get VED?

Hi Kev

No, not yet. You will have to wait a couple more years.

Our van was manufactured in February 1977 and registered june 1977 so my one will be tax free april 2018?

Yes, that’s right..

Hi Ian,

My T3 camper was made on 21-01-1980 and not registered until May 1981. Does this mean I will have to pay an extra two years tax?

Thanks for an answer,

George

Hi George, currently this only affects those with a vehicle made or registered in 1977.

By the time your 1980 model bus is eligible for exemption under this new rule (4 yrs from now by our reckoning) the Government could have changed it again, or even withdrawn it.

So, for the time being, enjoy driving your Bus, don’t expect your tax to be free ever, and if/when it happens then it’ll be a bonus!

Andy

so much for fbhc the government have pushed back the years and not a single quango has tried to stop them they have almost doubled the tax free time years they lost 90 million last year by removing tax discs even dough the old vehicles are mostly in much better condition than new crap I have a vw t25 1982 .a few years back I did not receive a tax renewal notice so I was feeling ok good I must be tax exempt last day phoned the DVLA LO AND BEHOLD BAD NEWS FROM THEM MY T25 HAD BEEN REMOVED TAUGHT THAT SOUNDED OK GOOD NO I WAS NOT TAX EXEMP BECAUSE THE YEARS HAD CHANGED SO COUPLE DAYS NEW NOTICE TO PAY TAX AND THAT IS IT SOON IT BE EXTENDED TO 50 YEARS AND THE ONLY ONES BE AROUND WILL BE THE 50 YEAR OLDS BECAUSE THE NEW ONES MADE AT PRESENT WILL NOT EXIST UNLESS THEY NOT TAKEN OUT OF GARAGE SO F.B.H.C. WHAT YOU THINK OF THAT

I own a 1971 beetle which comes under the Historic Road Tax exemptionot, I’very not paid road tax for years. The car has an 1982 plate as that was the year it was registered in the UK.

The new Historic Road Tax policy sets the 40 year rule from the date a vehicle is registered not manufactured. Does this potentially mean that my current historic road tax exemption may be taken away until 2022? I hope not!!!

I have a spyder kit car that is old parts added to a kit making it a kit converted car, it also has an age related plate of 72. The kit was built in 2009 so is the car a 72 or 09? On the v5 it has 72 but I believe it does not have historic taxation. So what’s the score with tax, mot and insurance for this?